Prices on the Iowa Electronic Markets’ (IEM) political prediction markets have been largely steady the last week, unmoved by the rapidly approaching Election Day or Hurricane Sandy thrashing the northeast.

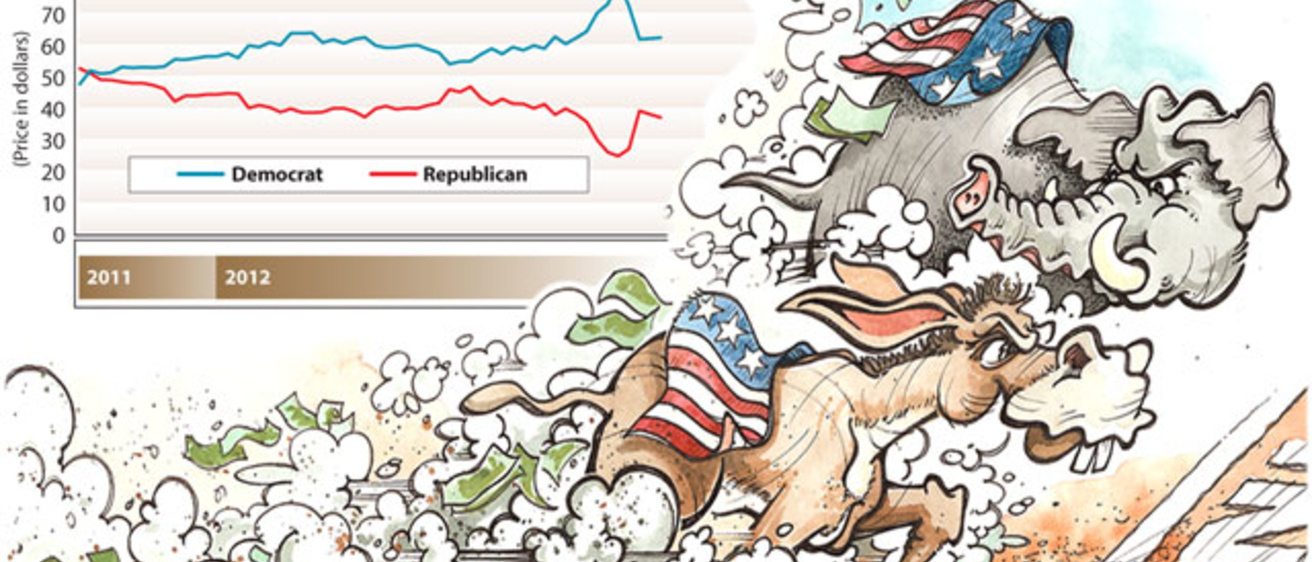

As of 9 a.m. Tuesday, a contract for President Barack Obama was trading for 63.8 cents on the IEM’s Winner Take All market, which means traders believe he has a 63.8 percent probability of winning the popular vote in next week’s election. He has been trading in the 60 to 65 cent range for most of the last two weeks.

Romney, meanwhile, was trading for 38.9 cents, which means traders believe he has a 38.9 percent probability of winning the popular vote. His current price also reflects his recent trading trend.

Volume yesterday was heavy, with more than 5,300 contracts trading hands.

On the IEM’s Vote Share market, which tracks the percentage of the two-party popular vote each candidate will receive, Obama was trading for 51.9 cents this morning, which means traders believe he will receive 51.9 percent of the vote between the two major party candidates. Romney was trading at 48.2 cents.

Meanwhile, on the IEM’s Congressional Control market, traders believe the current party configuration will hold in the next Congress. The contract representing a Republican House and Democratic Senate was trading for 80.5 cents Tuesday morning, which means traders believe there is an 80.5 percent probability that Congress will retain its status quo party alignment.

The contract representing a Republican sweep was selling for 8.4 cents. That contract peaked at 74.9 cents on July 8, and was still trading for as high as 54.4 cents on Sept. 8.

The contracts representing a Democratic sweep was trading at 1.9 cents, and a Democratic House-Republican Senate for less than 1 cent.

The contract for “other,” which represents neither party having enough members to control at least one chamber, was trading for 9 cents.

A real money futures market operated by the University of Iowa’s Tippie College of Business, the IEM gives traders the opportunity to buy and sell contracts based on what they think the outcome of a future event will be. The price of the contract at any given time is the probability that the traders believe that event will happen. Traders can invest up to $500 in the market.

The latest presidential election market prices are available at iemweb.biz.uiowa.edu/quotes/Pres12_quotes.html. Congressional Control market prices are online at iemweb.biz.uiowa.edu/quotes/Congress12_quotes.html.

More information on the IEM—including information on opening a trading account—is available at tippie.uiowa.edu/iem/markets/.