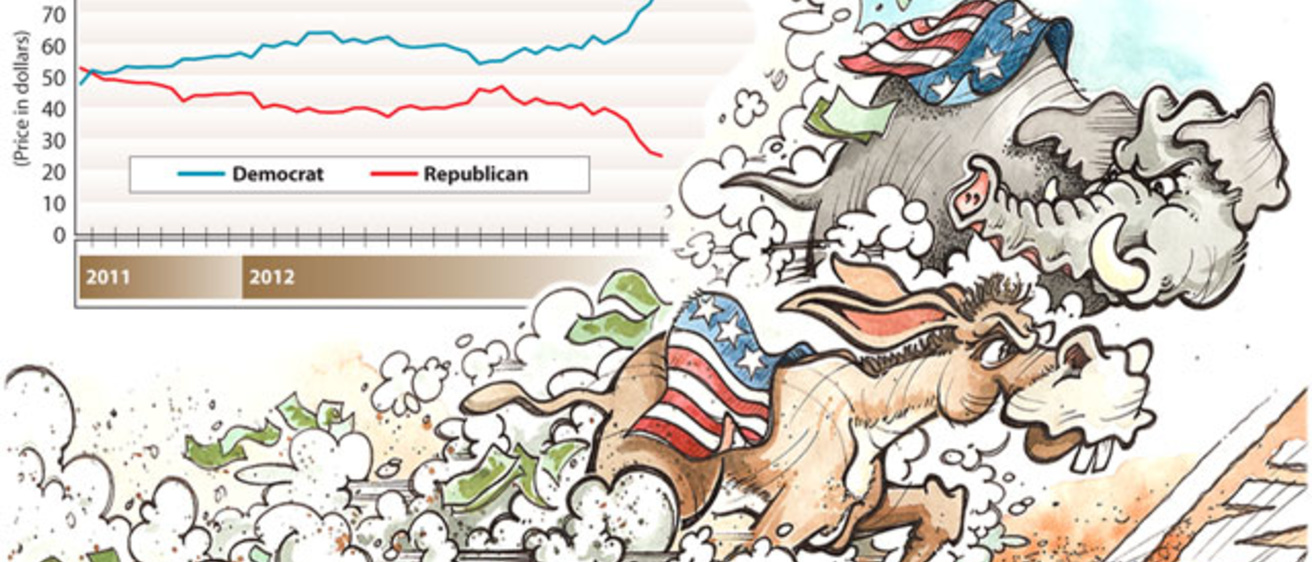

President Barack Obama remains a significant favorite on the Iowa Electronic Markets (IEM) over Mitt Romney, and political observers think that today’s first debate between the two is a good chance for Romney to give some momentum to his campaign.

Recent history has shown that debates have a mixed record of influencing candidates’ prices on the IEM.

As of 8:30 a.m. today, Obama was trading at 77.1 cents, which means traders believe he has a 77.1 percent probability of winning the popular vote in next month’s election. Romney, meanwhile, was selling for 23.1 cents. Both of those prices are in line with their recent trends, although Romney did spike to 27 cents for a time Tuesday before settling back to his current price.

Whether today’s debate influences those prices will be seen in the coming days. But in recent elections, some debates have had more of an impact on the market than others. In 2008, for instance, the first debate led to little change. Obama started trading on Sept. 26, the day of the debate, at 63.3 cents, and John McCain for 37. By the end of the day on Sept. 27, Obama had gone up only to 64.9 cents and McCain had dropped to 36 cents.

In 2004, the gaffe-free first debate had a greater impact on the market. George W. Bush started trading on the day of the debate—Sept. 30—at 78 cents, and John Kerry at 31. By the end of the next day, Bush had fallen 15 cents to 63, and Kerry had jumped to 37.

The opening debate in the 2000 election made for a classic Saturday Night Live sketch, and also had a moderate impact on the IEM. Al Gore jumped from 61.1 cents on debate day—Oct. 3—to 65.9 cents the day after, despite merciless teasing for his frequent use of the term "lockbox." Bush, meanwhile, dropped from 39.6 cents to 32.5.

A real money futures market operated by the University of Iowa’s Tippie College of Business, the IEM gives traders the opportunity to buy and sell contracts based on what they think the outcome of a future event will be. Contracts for the correct outcome pay off at $1, all other contracts pay off at zero. As a result, the price of the contract at any given time is the probability that the traders believe that event will happen. Traders can invest up to $500 in the market.

The latest general election market prices are available at iemweb.biz.uiowa.edu/quotes/Pres12_quotes.html. More information on the IEM—including information on opening a trading account—is available at tippie.uiowa.edu/iem/markets.